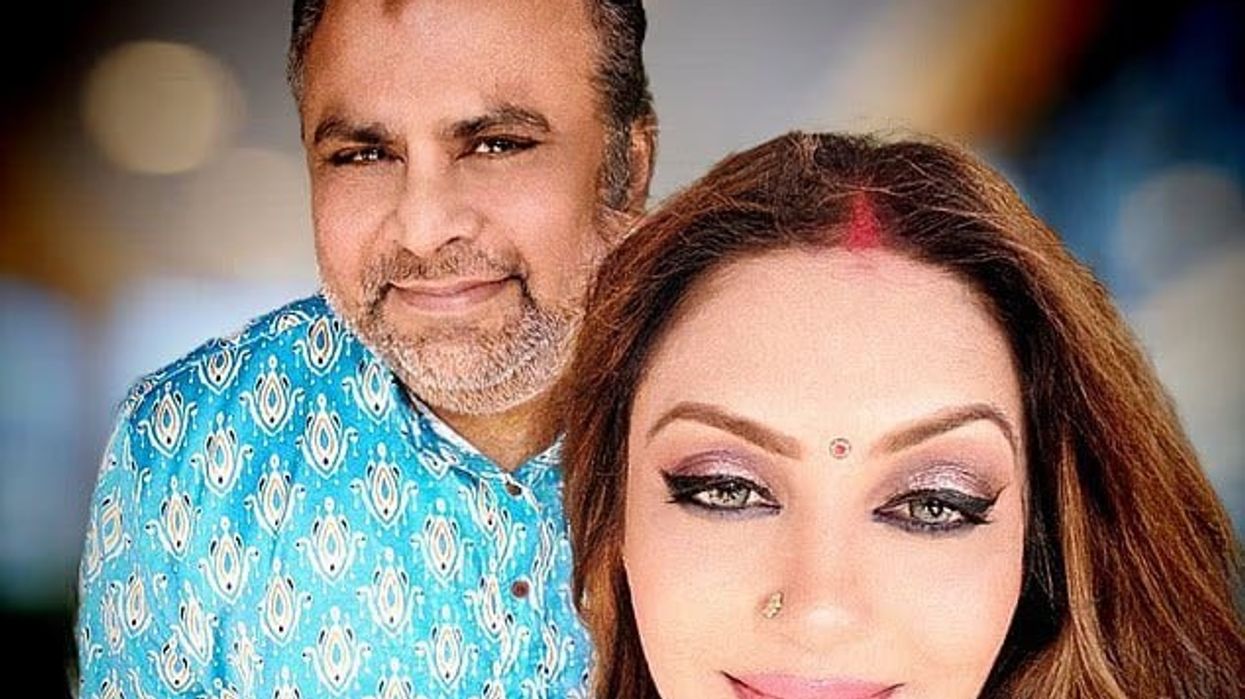

Sidhartha “Sammy” Mukherjee and his wife, Sunita, were well-known in Plano, Texas, as glamorous fixtures in the Indian-American community. Their Bollywood-style performances, high-profile parties, and charity galas won them trust and adulation. For years, the Mukherjees built a façade of success, frequently headlining cultural events and presenting themselves as accomplished businesspeople.

Their public image, however, masked a sprawling scam that federal investigators now allege defrauded over 100 people of more than $4 million (₹33 crore). According to the FBI and local authorities, the couple leveraged their social standing to convince acquaintances and community members to invest in high-return real estate projects—projects that never actually existed.

Real estate, fake documents, and high returns

According to law enforcement, the Mukherjees’ scheme revolved around credible-looking but fictitious real estate deals. Potential investors were promised unusually high returns and shown convincing paperwork, including forged remodeling contracts and invoices that appeared to come from the Dallas Housing Authority. The couple’s ability to provide plausible documents and their charismatic presence at community events made it easier to win people’s confidence.

Most victims remained unaware until the so-called dividend or return cheques began bouncing. The scam unraveled in 2024 when one couple, having lost $325,000, filed a complaint—prompting Euless Police detective Brian Brennan to open a criminal investigation. Soon, the FBI joined as more victims came forward, and evidence accumulated that the Mukherjees’ “business” was, in fact, a coordinated fraud.

As one victim, Terry Parvaga, told CBS News, “They will make you believe that they are very successful businesspeople. But they will take every single penny you have.”

Threats and expanding the racket

The scheme, investigators allege, was both prolific and aggressive. The Mukherjees even targeted elderly victims, sending threatening emails warning of imminent arrest unless immediate payments were made. Beyond the real estate fraud, they are accused of submitting falsified documents to obtain federal pandemic relief under the Paycheck Protection Program (PPP) by fabricating employees and payroll records, as noted in arrest affidavits.

When pressed by the FBI, Sidhartha Mukherjee reportedly denied knowing the names on the payroll paperwork attached to their federal loan application.

Collapse, bankruptcy, and detention

Despite increasing scrutiny, the couple maintained their public presence and continued socializing in Texas’s high society until their arrest in June 2025. As suspicions mounted, the Mukherjees filed for bankruptcy in 2024, raising further questions about the fate of the stolen funds.

Authorities are now investigating whether the proceeds were moved offshore or into cryptocurrency. Both are now being held in a US Immigration and Customs Enforcement detention facility. They face first-degree felony theft charges, and if convicted, could be sentenced to five to 99 years in prison.

Federal records also indicate that Sidhartha Mukherjee has outstanding fraud warrants in Mumbai, but the couple’s current immigration status is yet to be clarified.

A stark lesson for the community

Detective Brennan, who spearheaded the case, called Sammy Mukherjee “the most prolific fraudster” he’s encountered in over two decades of law enforcement. As of July 2025, only about 20 victims have been officially documented, but authorities believe over 100 people may ultimately be counted among those who lost their savings in the Mukherjees’ elaborate fraud.

The case is not only a cautionary tale about misplaced trust and the risks of high-yield investment promises, but also a reminder that sometimes, those who shine brightest in public may be hiding far darker secrets beneath the surface.