- Saturday, July 27, 2024

Major players such as Goldman Sachs Group Inc. and Morgan Stanley are backing the South Asian nation as the key investment destination for the coming decade.

By: Shubham Ghosh

GLOBAL markets were witnessing a significant transformation as investors are withdrawing billions of dollars from China’s faltering economy, marking a stark departure from the past two decades when the country was seen as the premier growth opportunity worldwide.

Much of this capital is now flowing towards India, with major players on Wall Street such as Goldman Sachs Group Inc. and Morgan Stanley championing the South Asian nation as the key investment destination for the coming decade, Bloomberg reported.

This shift in sentiment is sparking a frenzied rush for opportunities. Marshall Wace, a British hedge fund with assets totaling $62 billion, has positioned India as its largest net long bet after the United States in its flagship fund. A subsidiary of Zurich-based Vontobel Holding AG has also elevated India to its top emerging-market position, while Janus Henderson Group Plc is actively exploring fund-house acquisitions. Even Japan’s traditionally risk-averse retail investors are focusing on India and reducing their exposure to China.

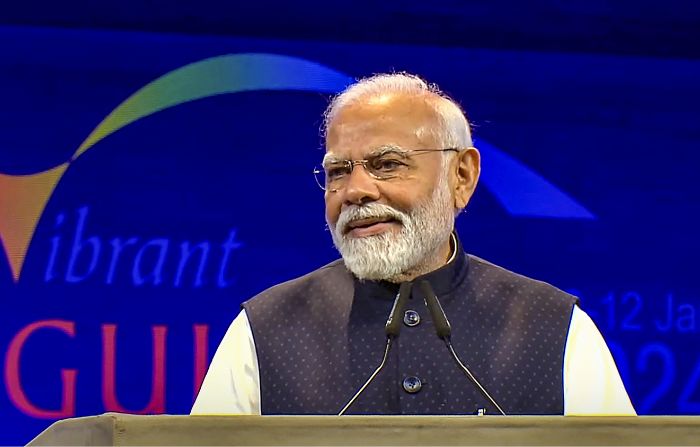

Investors are closely monitoring the diverging paths of both the prominent Asian nations. India, recognised as the world’s fastest-growing major economy, has significantly enhanced its infrastructure under the leadership of prime minister Narendra Modi, aiming to attract global investment and divert supply chains from Beijing. Conversely, China is contending with persistent economic challenges and an increasingly strained relationship with the West-dominated international order.

Read: India PM makes big post-poll claim about economy: ‘This is Modi’s guarantee’

“People are interested in India for several reasons – one is simply it’s not China,” Vikas Pershad, Asian equities portfolio manager at M&G Investments in Singapore, was quoted as saying by Bloomberg.

“There’s a genuine long-term growth story here.”

While the optimistic outlook on India is not new, investors are increasingly recognising similarities with the China of yesteryears: a vast and dynamic economy that is progressively opening up to global investment through innovative channels. While no one anticipates a seamless journey, many perceive India as an opportunity akin to China’s past trajectory. Despite challenges such as widespread poverty, expensive stock markets, and isolated bond markets, investors are crossing over, weighing the risks of not participating against those of investing in India.

Read: Tata, Pegatron in partnership talks for iPhone assembly in India

Historical data illustrate a close correlation between India’s economic growth and the performance of its stock market. With a sustained growth rate of seven per cent, the market size is anticipated to increase at least at that pace on average. Over the last two decades, both gross domestic product and market capitalization have surged in tandem, soaring from $500 billion to $3.5 trillion.

Aniket Shah, the global head of the environment, social, and governance practice at Jefferies Group LLC, noted that a recent investor call focusing on India was one of the firm’s most well-attended sessions.

“People are really trying to figure out what’s going on in India,” he told Bloomberg.

Despite the buoyant mood, however, Indian equities face significant challenges. The enthusiasm has propelled Indian stocks to become some of the priciest globally. The widely followed S&P BSE Sensex Index has nearly tripled since hitting its low in March 2020, whereas earnings have only approximately doubled. Presently, the gauge trades at more than 20 times future earnings, 27 per cent dearer than the average for the 2010 to 2020 period.

These lofty valuations, coupled with Beijing’s recent efforts to bolster its own markets, have prompted some investors to reassess their strategies. In January, global funds withdrew over $3.1 billion from Indian shares, marking the largest monthly outflow in a year, according to Bloomberg data.

Mark Williams, a fund manager at Somerset Capital Management, said, “An enormous success is priced into India’s markets. But the question is how much of that is not priced in. There’s certainly a risk that Indian markets can go sideways for some years.”

Investors are bracing for a potential correction following eight consecutive years of annual gains in local shares. PM Modi is widely expected to secure a third term in office during this year’s national elections, especially following his party’s recent electoral victories at the state level, which signal a continuation of existing policies. However, any signs of weakness in the ruling party could unsettle markets in the short term.

Peeyush Mittal, portfolio manager at Matthews International Capital Management LLC, said while the outcome of the state elections suggests continuity in government, but surprises are always possible.

Furthermore, Modi’s social agenda, which critics argue favors the Hindu majority, poses a threat to stability in a country with over 200 million religious minorities. The challenge of translating India’s potential into tangible economic benefits for all citizens is formidable, particularly in a multilingual democracy with substantial cultural disparities among states.

“India still has a long way to go,” Charles Robertson, head of macro strategy at FIM Partners Ltd., was quoted as saying by Bloomberg. “Potential peak growth is still under what China did achieve.”