- Monday, April 29, 2024

As per Bloomberg Billionaires Index, 10 Indian families have scions aged 40 and under occupying prominent positions. This figure is three times higher than what equivalent Chinese heirs can anticipate inheriting.

By: Shubham Ghosh

IN India’s family-owned conglomerates, succession planning is ramping up significantly.

With the current generation of ageing tycoons focusing on the future, their successors are assuming progressively significant roles within major business empires — spanning from the Ambanis, Adanis, Birlas, and beyond.

According to the Bloomberg Billionaires Index, a total of 10 Indian families, with a combined net worth of $382 billion, have scions aged 40 and under occupying prominent positions. This figure is three times higher than what equivalent Chinese heirs can anticipate inheriting.

This wealth gap also mirrors the divergent economic paths of the two nations. While Chinese stocks have declined due to weakening growth, impacting billionaires’ wealth, there is growing optimism in India’s long-term prospects, with its equities trading near all-time highs.

As the Indian economy continues to grow, conglomerates are expanding their operations into new sectors such as green energy and e-commerce. Many are targeting the younger consumer base of the world’s most populous nation, and it’s often expected that the children of patriarchs, many of whom hold degrees from prestigious western universities, will play a significant role in this endeavour.

Take for example, the Birlas — a family that has been instrumental in building one of India’s oldest businesses, with roots tracing back over 165 years when India was still in the colonial era. Recently, current patriarch Kumar Mangalam Birla appointed heirs singer Ananya and former cricketer Aryaman Vikram to the boards of three of the clan’s businesses.

“Their nuanced understanding of new-age business models and emerging shifts in consumer behaviour will infuse fresh energy to the board,” Kumar said when they joined the fashion arm in January last year, Bloomberg reported.

Another significant conglomerate family in India that recently entrusted prominent roles to its scions is the Ambanis led by India’s richest man Mukesh Ambani. Last year, Mukesh appointed his three children as non-executive directors to the board of his flagship company, Reliance Industries Ltd. He also announced his plan to dedicate five years to grooming them to become top leaders of the empire.

For the Ambanis, succession is not new. Mukesh’s younger brother Anil got Reliance’s telecom, financial services and other fledgling businesses as part of a family truce following a prolonged fraternal dispute after the death of their legendary industrialist father Dhirubhai Ambani who had not left behind a will. Mukesh’s oil-and-petrochemicals operations succeeded but his brother’s assets dwindled. In 2019, the latter’s telecom unit filed for bankruptcy.

But Mukesh, by attaching significance to the succession plan including his three children, is ensuring that history doesn’t repeat after him.

Like the new-age Ambanis, performance of the next-generation leadership across all business dynasties in India will be closely watched in the times ahead — both by investors and their wider families — in their new roles and how they carry the baton forward after the seniors.

According to Kavil Ramachandran, who teaches at the Thomas Schmidheiny Centre for Family Enterprise of the Indian School of Business in the southern Indian city of Hyderabad, “it’s a make-or-break situation”.

Speaking to Bloomberg, he said not all heirs have the professional track record normally required for such big responsibilities.

“Most ascend to the top via the elevator route.”

Bloomberg listed 16 Indian heirs aged 40 or below who are gearing up to spearhead operations at some of India’s wealthiest business houses. Many of them are expected to share their inheritance with siblings, and even cousins. In case of Pallon Mistry, for instance, it includes both his sister and Firoz and Jahan, the two sons of his uncle Cyrus Mistry who died in a car crash in September 2022.

Akash, Isha & Anant Ambani — Children of Mukesh Ambani of Reliance Industries; family worth $113.5b

Akash Ambani, who pursued economics at Brown University in the US, serves as the chair of Reliance’s telecom subsidiary, Jio Infocomm. His twin sister Isha holds an MBA from Stanford University and is a non-executive director at the conglomerate’s e-commerce division, Reliance Retail Ventures. Anant, who, like his brother, holds a degree from Brown University, is deeply involved in the conglomerate’s transition to renewable energy.

Reliance Industries, which is headquartered in Mumbai, is India’s largest company by market value. Besides owning the world’s biggest oil-refining complex, the conglomerate has been expanding into areas like green energy, e-commerce, mobile phones and financial services.

Karan and Jeet Adani — Children of Gautam Adani of Adani Group; family worth $102.4b

Karan Adani, the eldest son of Gautam Adani, holds an economics degree from Purdue University in the US and currently serves as the managing director of Adani Ports and Special Economic Zone. His brother Jeet, who attended the University of Pennsylvania, holds the position of vice president of group finance at the flagship Adani Enterprises.

The Adani Group, which originated as a modest agricultural trading company in the late 1980s, has evolved into one of India’s leading infrastructure conglomerates. It possesses the nation’s largest private port and ranks among the world’s largest coal traders.

Pallon Mistry — Son of Shapoor Mistry of Shapoorji Pallonji & Co; family worth $37.7b

Pallon Mistry, the son of Shapoor Mistry, completed his master’s degree from Imperial College London and currently holds a directorship on the board of Shapoorji Pallonji & Co, which is chaired by his father Shapoor Mistry. In 2019, he was appointed to the board of the group holding company, as confirmed by sources within the company. Meanwhile, his sister Tanya is reported to be tasked with overseeing group corporate social responsibility initiatives.

Set up in 1865 as a construction firm, the business has since expanded into various industries, including engineering and real estate. It has undertaken notable projects across Asia, constructing luxury hotels, stadiums, palaces, and factories. Some of its landmark projects include the Reserve Bank of India in Mumbai and the Al Alam Palace for the Sultan of Oman. Additionally, the founding family holds a stake in Tata Sons, the principal holding company of Tata Group, which oversees Jaguar Land Rover.

Aalok Shanghvi: Son of Silip Shanghvi of Sun Pharmaceutical Industries; family worth $26.7b

Aalok, holding a degree in cellular and molecular biology from the University of Michigan, serves as an executive director at Sun Pharma which was founded in 1983 and is one of the world’s largest generic drugmakers. The company has over 40 manufacturing facilities and 41,000 employees.

After joining Sun in 2006 and handling various roles in marketing, R&D, project management, purchase and communications, Aalok headed Bangladesh in 2010 and by 2014, he was leading the Emerging Markets business, which is spread across 80 nations in Africa, Middle East, APAC, Eastern Europe, and other regions, according to the company website.

Manjri Chandak — Daughter of Radhakishan Damani of Avenue Supermarts; Family worth $21.1b

Manjri, holding a post-graduate degree in finance and investment from the University of Nottingham, serves on Avenue Supermarts’s board.

The company began with D-Mart, a no-frills supermarket chain founded by Radhakishan Damani in the early 2000s, following his successful stock-trading ventures. It has grown into a significant retail chain, operating nearly 350 stores across India. The company’s approach is focused on offering affordable products. Damani has been likened to India’s Sam Walton for his achievements in the retail sector.

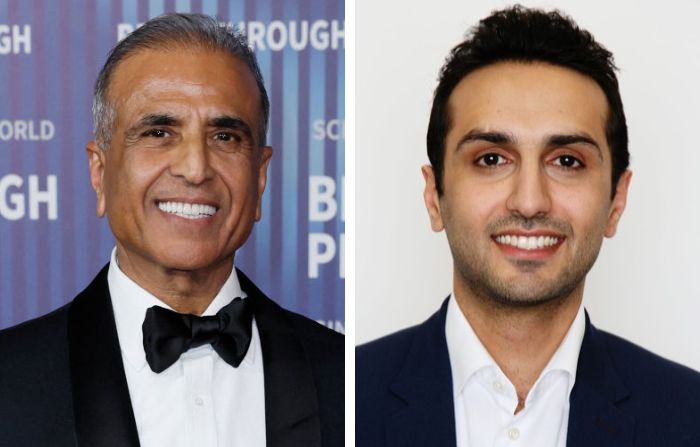

Shravin Mittal — Son of Sunil Mittal of Bharti Enterprises; family worth $19b

Shravin has an MBA from Harvard Business School and he initially worked in private equity and investment banking before assuming roles within his family’s businesses. He is the founder of Unbound, a technology-focused investment firm; serves as the managing director of Bharti Global, the family’s investment arm; and holds a directorship at Airtel Africa.

Based in New Delhi, Bharti Enterprises operates across various sectors, including technology and financial services, with a presence in India and numerous African countries. Its primary business, Bharti Airtel, ranks among the largest mobile service providers globally and is India’s second-largest wireless operator. Sunil Mittal, the founder of Bharti, played a pivotal role in the rescue of OneWeb, a competitor to Elon Musk’s Starlink, which aims to deliver satellite broadband services.

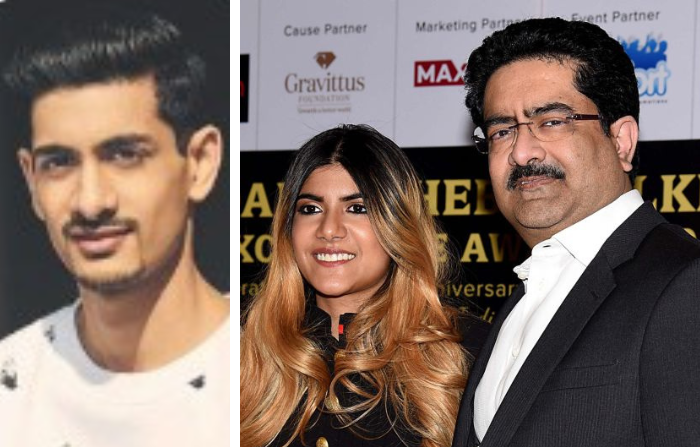

Ananya and Aryaman Vikram Birla — Children of Kumar Mangalam Birla of Aditya Birla Group; family worth $18.8b

Ananya and Aryaman Virkram Birla serve as board directors across various sectors of the family’s business empire, spanning fashion, paints, and strategic operations. Before joining the conglomerate, Aryaman enjoyed a successful career as a professional cricketer and went on to establish and manage Aditya Birla Ventures. On the other hand, Ananya, who initiated a micro-finance organization at the age of 17, also showcases her talents as a singer.

Originating as a cotton-trading enterprise in the 19th century, the Aditya Birla Group stands as one of India’s most enduring family-owned enterprises. Over time, it has diversified its portfolio, spanning various sectors such as metals, financial services, and retail. Notably, a forebear of the family played a pivotal role in India’s independence movement and served as an associate of the iconic Mahatma Gandhi.

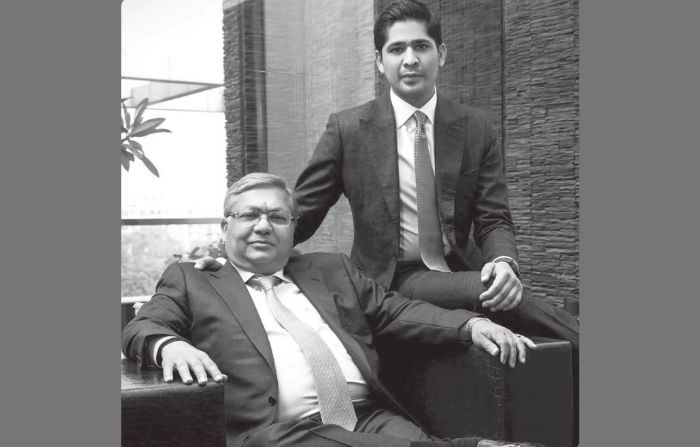

Varun Jaipuria — Son of Ravi Jaipuria of RJ Corp.; family worth $15.6b

Varun serves as the promoter, executive vice chairman and whole time director of Varun Beverages. He holds a degree in international business from Regent’s University London and has participated in a leadership development programme at Harvard Business School. He is also a Harvard Alumni and had too part in Program for Leadership Development, 2018-2019 batch from Harvard Business School, Boston.

Varun has been deeply involved in the operations of Varun Beverages since 2009, playing a pivotal role in driving its comprehensive business growth, including overseeing acquisitions and integrating acquired territories.

His leadership has propelled Varun Beverages to prestigious accolades, including being named PepsiCo’s Bottler of the Year in 2023 and the Best Bottler in the AMESA (Africa, Middle East, and South Asia) sector in 2021.

RJ Corp. operates across diverse sectors including food, beverage, healthcare, and education. However, its subsidiary, Varun Beverages, garners significant recognition. Varun Beverages stands as one of the largest international franchisees of PepsiCo outside the United States, specializing in bottling and distribution.

Jay Kotak – Son of Uday Kotak of Kotak Mahindra Bank; family worth $14.1b

Jay Kotak holds the position of senior vice president, overseeing conglomerate relationships at Kotak Mahindra Bank, while also serving as co-head of the digital bank 811. He graduated with a BA in history from Columbia University and pursued further education, earning an MBA from Harvard Business School.

Headquartered in Mumbai, Kotak Mahindra Bank offers a wide array of financial services, including commercial and investment banking, insurance, and brokerage services. With a network comprising approximately 1,800 branches, the bank remains a prominent player in the financial sector.

Aman, Shaan and Varun Mehta – Children of brothers Samir and Sudhir Mehta of Torrent Group; family worth $13.2b

Aman, holding an MBA from Columbia University, assumed a position on the Torrent Pharma board in August 2022. He looks after the company’s Indian operations. Meanwhile, his brother Shaan, also an MBA graduate from Columbia, serves as the general manager.

Varun, the son of Samir’s brother Sudhir, holds a directorial role at Torrent Power. He holds an MBA from INSEAD.

The Torrent Group oversees one of India’s leading pharmaceutical companies, Torrent Pharma. Additionally, it manages a publicly traded division, Torrent Power, along with a gas distribution enterprise and a power cable supply operation.

![]()