- Tuesday, May 07, 2024

By:

Gold is a commodity that has kept its value over time since interest rate decisions do not affect its value. Since gold is considered a store of value, commodity trading investors invest in gold when there are higher inflationary pressures. Gold acts as asafehaven asset and some consider it to be a hedge against the US dollar during periods of market volatility. Not surprisingly, the pandemic increased the attractiveness of gold to some investors.

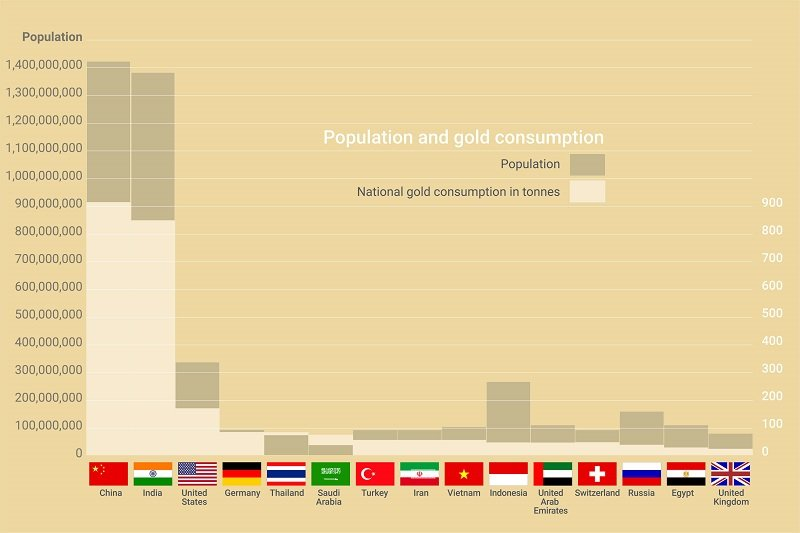

Currently, it is estimated that miners have extracted 201,296tonnes of gold from the ground, while 53,000tonnes of gold remain in underground reserves. Nearly half of all gold that has been mined is held as jewelry, while the remaining gold is held in the form of bars, bullion, or coins for commodity trading investment purposes. Below are further details about the top ten countries with the greatest gold production, consumption, and reserves.

China

China has been the top gold producing nation for many years and makes up about 11% of the world’s gold production. In 2020, China produced 368.3tonnesof gold. Chinais also the greatest consumer of gold with around 1,003tonnes in 2020. Despite the country’s significant production and consumption, only 1,948tonnesof gold are held as reserves, placing it sixth for gold reserves globally.

India

Gold has a very special place in Indian culture. It is a symbol of wealth, power, status, and a fundamental part of many rituals. Among therural population, a deep affinity for gold goes hand in hand with practical considerations of the portability and security of jewelry as an investment. Despite being the second largest consumer, India is not a major producer of gold. In 2020, India produced only 1.72 tonnes of gold while the demand stood at 446.4tonnes. India ranks 9th with 744tonnes of gold reserves.

https://www.bullionbypost.co.uk/index/gold/largest-consumer-of-gold-in-the-world/

Russia

In 2019, Russia overtook Australia to be the world’s secondlargest producer of gold, producing 329.5 tonnes, 4.4 tonnes more than Australia. In 2020, Russia produced 331.1 tonnes, 3.3 tonnes more than Australia. The largest consumer of gold in Russia is the Russian government, purchasing two-thirds of Russia’s gold. Russia was fifth in gold reserves at 2,299tonneslast year.

Australia

Australia produced 327.8 tonnes of gold and has increased production for eight consecutive years. However, the country has only 279.99 tonnes in reserves and is not a big gold consumer.

United States

Goldproduction declined to 190.2 tonnes in the United States and, for the firsttime,output dipped below 200 tonnes in several years. Despite that, the US has the largest gold reserves globally at 8,133 tonnes. This amount is more than twice the reserves of Germany, the secondlargest gold reserve globally. The US ranked third in gold consumption with 160tonnes of gold.

Canada

Canada ranked fifth in gold production with 170.6 tonnes in 2020. However, Canada did not place in the top ten for gold reserves or gold consumption.

Ghana

Ghana, Africa’s largest gold producer, produced 138.7 tonnes of gold in 2020. However, like Canada, it does not fall in the top ten for gold consumption and gold reserves.

Brazil

Brazil took the seventh spot and increased its gold production for the third consecutive year. The country produced 107tonnes of gold.

Uzbekistan

Uzbekistan was 15th in gold reserves and did not make the top ten for gold consumption.The country produced 101.6 tonnes this past year.

Mexico

Mexico ranked 9th, producing 101.6 tonnes gold in 2020.

Indonesia

Indonesia produced 100.9 tonnes of gold as the 10th largest gold producer in 2020.

The Bottom Line

Since the value of gold increases during economic downturns, CFD commodity trading investors turned to gold as a safe haven during the pandemic. The attractiveness of gold increased its price, which can act as an indicator for commodity traders to invest in gold prices as CFDs. In July 2020, gold prices reached an all-time high. However, gold mining production was down overall due to the pandemic, which questions the implications of gold production for the future.

Although gold production has slowed down, countries that have been in the top ten in the past are no longer given, as that volume has rapidly declined. For example, South Africa (once the world’s largest gold producer in the 1970s) and Peru left the top ten, making room for Brazil to move up and Uzbekistan to enter the rankings.

![]()