- Dollar eases as December rate-cut odds climb to 69 per cent.

- Mixed Fed remarks drive uncertainty ahead of PPI data.

- Consumer sentiment rises, with inflation expectations cooling.

- DXY uptrend intact but momentum fades below resistance.

GBP/USD and EUR/USD stabilize at key technical support zones. Global stocks rose on Monday (24), as growing expectations of a Federal Reserve rate cut in December helped offset some of the recent investor angst over excessive tech valuations that have stirred up volatility this month.

Markets are gearing up for the release of US retail sales and producer prices data later in the week, as well as British finance minister Rachel Reeves' highly anticipated budget on Wednesday (26).

Geopolitical developments were also in focus. The US and Ukraine were continuing work on a plan to end the war with Russia, after agreeing to modify an earlier proposal that was seen by Kyiv and its European allies as too favourable to Moscow.

That weighed on oil prices, as a deal could theoretically release more Russian supply through an easing of sanctions. Stocks in Europe rallied in early trading, playing catch-up with the late bounce on Wall Street on Friday (21), but were more or less unchanged around midday, as losses in defence stocks mounted, leaving the STOXX 600 (.STOXX), opens new tab, which ended last week with a loss of 2.2 per cent, up 0.1 per cent.

The latest gains came after influential Fed policymaker John Williams said on Friday that interest rates could fall "in the near term", raising the possibility of another cut in December.

"We expect another Fed cut in December, followed by two more moves in March and June 2026 that take the funds rate to 3-3.25 per cent," said Goldman Sachs chief economist Jan Hatzius in a note.

"The risks for next year are tilted towards more cuts, as the news on underlying inflation has been favourable and the deterioration in the job market ... might be difficult to contain via the modest cyclical growth acceleration we expect."Fed funds futures now point to a roughly 65 per cent chance that the Fed will cut by 25 basis points next month.

DATA FOG PERSISTSA record US government shutdown that ended earlier this month has muddied the outlook for US rates, as policymakers grapple with gaps in data that would normally guide their view of the world's largest economy.

The US Bureau of Labor Statistics said on Friday it had cancelled the release of October's consumer price report because the shutdown had prevented the collection of data.

Generali Investments senior economist Paolo Zanghieri said he and his team believed the market was pricing in more rate cuts than the Fed might deliver."We see the chance of a cut next month as 50/50.

Given limited new data, it would be reasonable for the Fed to wait until January, while signalling an easing bias," he said."More importantly, market expectations for nearly four cuts next year, based on hopes for rapid disinflation, appear too optimistic. We expect only 50 basis points of easing by summer," he added.

The main focus in the currency market was on the yen, which was pinned near a 10-month low, as the dollar gained another 0.3% to trade at 156.81 yen. In November so far, the Japanese currency has lost around 1.8% in value, making it the worst-performing major currency against the dollar this month.

Traders have been alert to the risk of intervention from Japanese authorities to prop up the yen, which has come under pressure from growing worries about the nation's fiscal health and low domestic rates.

Finance Minister Satsuki Katayama ramped up her verbal efforts to support the currency last week, which seems to have put a floor under the currency for now.

"Dollar/yen will definitely be going upwards even if you try to intervene. So I think they will have to live with this. The only way for them to do it is intervention to stop the pace, maybe, but I don't think they can stop the direction," said Saktiandi Supaat, regional head of FX research and strategy for global markets at Maybank.

The dollar was weaker against most other currencies, given the rising expectations for the Fed to cut rates next month, with the euro up 0.3 per cent to $1.1548, while sterling rose 0.1 per cent to $1.3114 ahead of Wednesday's budget announcement.

In commodities, Brent crude futures held steady around $62.59 a barrel, having touched a session low below $62 earlier, while spot gold rose 0.35 per cent to $4,079 an ounce.

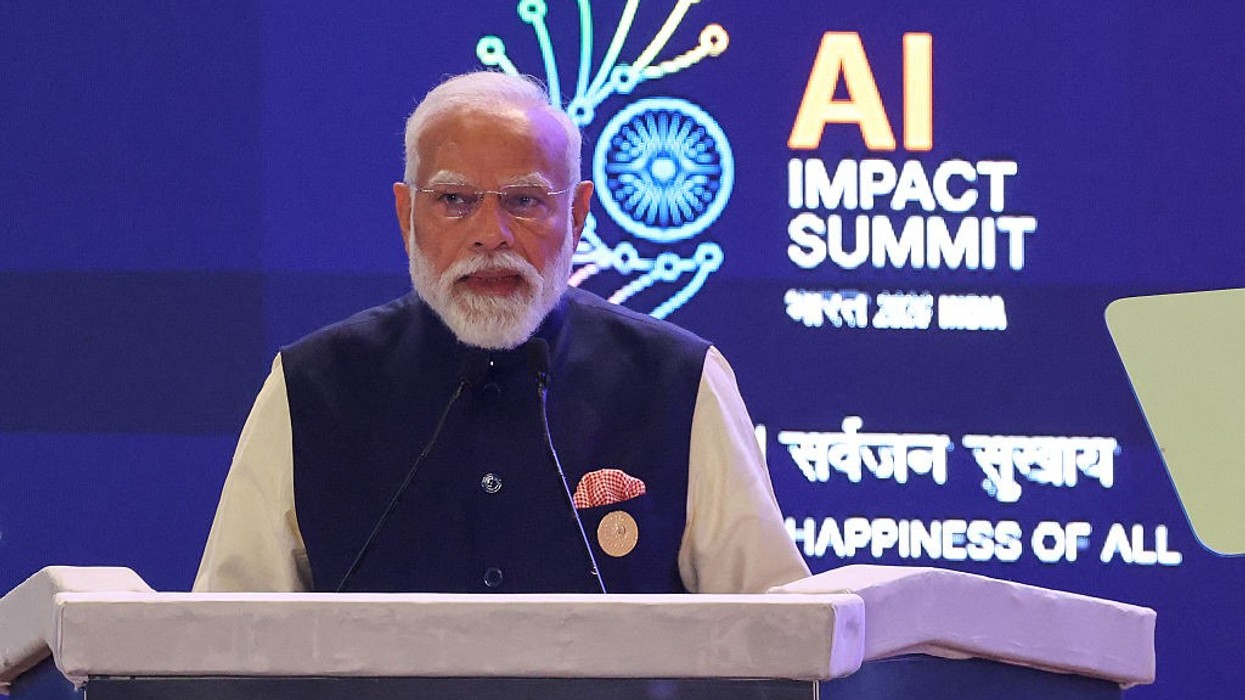

Aalok Mehta suggested India’s linguistic diversity and key sectors such as agriculture, health, and education could be areas where AI can be deployed.Eastern Eye

Aalok Mehta suggested India’s linguistic diversity and key sectors such as agriculture, health, and education could be areas where AI can be deployed.Eastern Eye