- Over 50 entities sanctioned by the US Treasury for aiding Iran’s oil and LPG exports.

- Three Indian nationals —Varun Pula, Soniya Shrestha, and Iyappan Raja—identified for shipping Iranian petroleum products.

- Sanctions freeze assets and prohibit US transactions with designated persons or entities.

- Shadow fleet vessels and China-based refineries included in the crackdown network.

Aim: To disrupt Iran’s terror financing and pressure the regime to alter its behavior. The US Department of the Treasury's Office of Foreign Assets Control (OFAC) on Thursday (9) announced sweeping sanctions against over 50 individuals, entities, and vessels accused of helping Iran export oil and liquefied petroleum gas (LPG). The sanctions target a global network that has allegedly enabled billions of dollars in petroleum sales, generating critical revenue for Iran's regime and its affiliated terror groups.

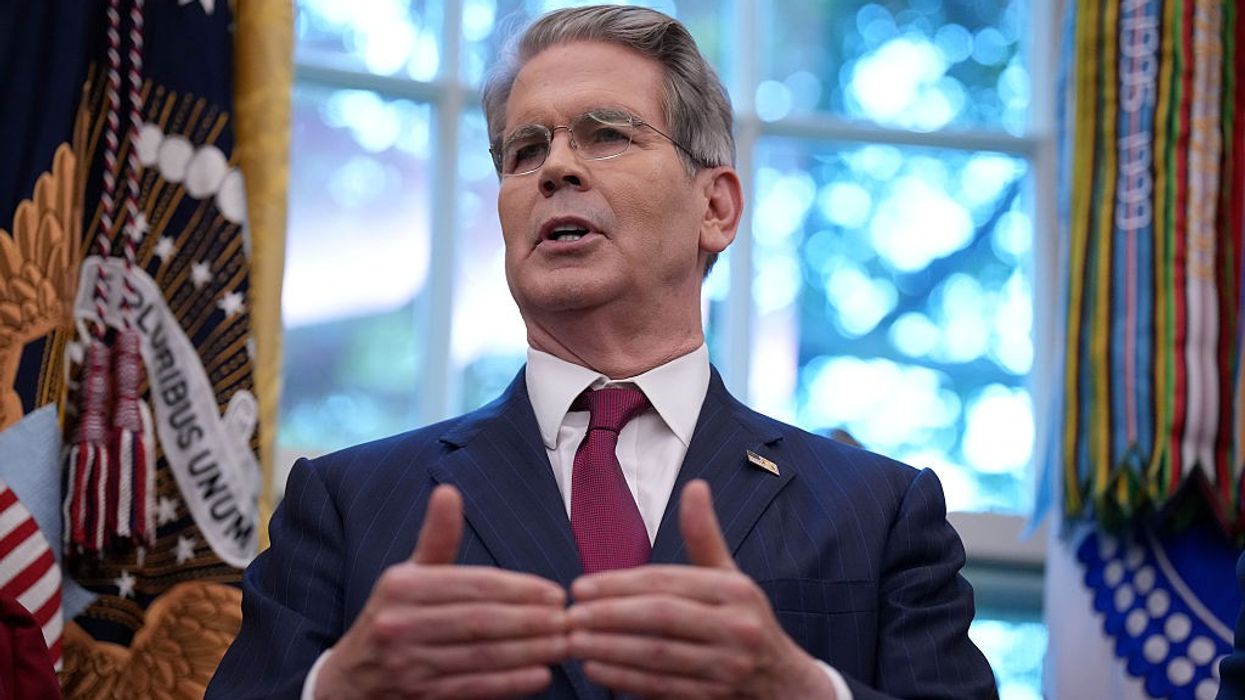

Treasury Secretary Scott Bessent stated that the move reflects the Trump administration's commitment to 'degrading Iran's cash flow by dismantling key elements of its energy export machine,' emphasizing that Washington is disrupting Tehran's ability to fund organizations threatening US security.

Indian nationals among those sanctioned

Three Indian nationals, Varun Pula, Soniya Shrestha, and Iyappan Raja, have been sanctioned under Executive Order 13902 for acting directly or indirectly on behalf of shipping firms involved in transporting Iranian petroleum products and LPG.

Varun Pula, owner of Bertha Shipping Inc. (Marshall Islands), operates the Comoros-flagged vessel PAMIR (IMO 9208239), which transported nearly four million barrels of Iranian LPG to China since July 2024.

Iyappan Raja, owner of Evie Lines Inc. (Marshall Islands), operates the Panama-flagged vessel SAPPHIRE GAS (IMO 9320738), which has carried over a million barrels of Iranian LPG to China since April 2025.

Soniya Shrestha, owner of Vega Star Ship Management Pvt. Ltd. (India), operates the Comoros-flagged vessel NEPTA (IMO 9013701), which has transported Iranian LPG to Pakistan since January 2025.

The new sanctions freeze all property and interests in property belonging to the designated individuals and entities within the United States or under US jurisdiction. Any company owned 50 percent or more by one or more blocked persons is automatically considered a blocked entity. Additionally, US persons and institutions are prohibited from engaging in any transactions involving the sanctioned parties unless explicitly authorized by OFAC.

Violations may lead to civil or criminal penalties for both American and foreign actors.

Targeting Iran’s ‘shadow fleet’

The Treasury release highlights that the targeted network includes nearly two dozen shadow fleet vessels, a China-based crude oil terminal, and an independent refinery involved in laundering Iranian energy exports. This action aims to cut off Iran’s financial support for militant proxies and weaken its capacity to sustain regional destabilization efforts.

Path to removal from sanctions list

While the sanctions are comprehensive, the Treasury Department clarified that individuals or entities designated under these measures may seek removal from the sanctions list through established legal procedures—provided they demonstrate a verifiable change in conduct or compliance with US law.