- Tuesday, April 30, 2024

By: Shubham Ghosh

HERE are news in brief on Indian economy and business for Wednesday, April 17, 2024:

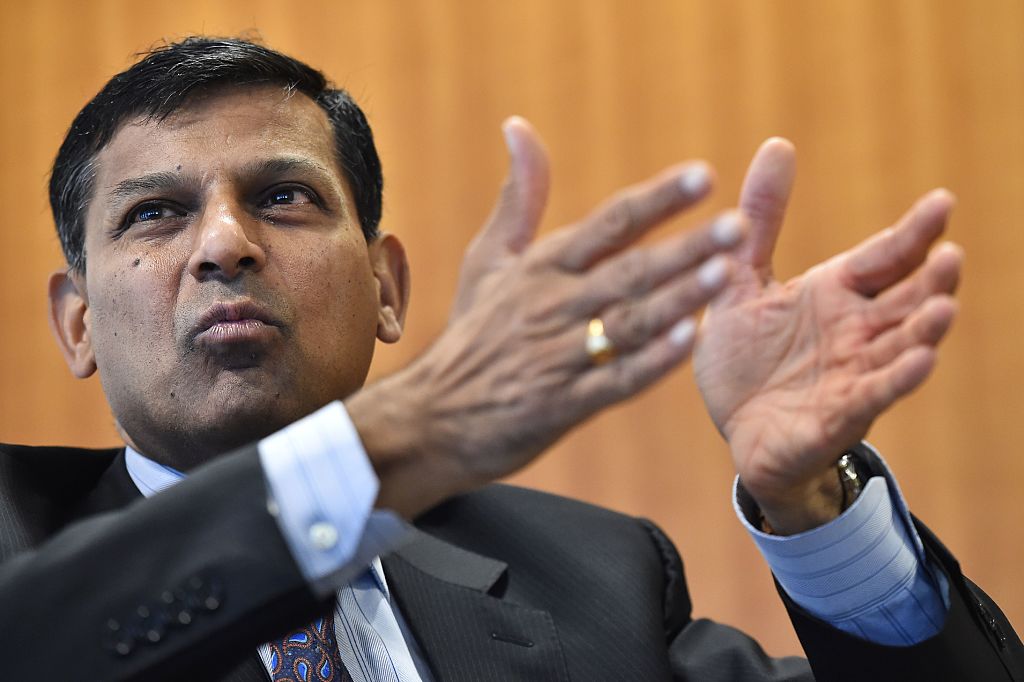

India is not reaping the benefits of demographic dividends, the former governor of the Reserve Bank of India (RBI), Raghuram Rajan said on Tuesday. He emphasised that there is a need to focus on improving the human capital and enhancing their skill sets. “I think we are in the midst of it (demographic dividend), but the problem is we are not reaping the benefits,” Rajan said at a conference on “Making India an Advanced Economy by 2047: What Will it Take” at the George Washington University in Washington. “That’s why I said 6 per cent growth. If you think that’s about what we are right now, take away the fluff in the GDP numbers. That 6 per cent is in the midst of a demographic dividend. It is much below where China and Korea were when they reaped their demographic dividend,” he said.

Elon Musk, the CEO of Tesla, is poised to unveil an investment plan of $2-$3 billion (£1.6 billion-£2.4 billion) in India, primarily directed towards establishing a new factory. This announcement is anticipated to occur during his visit to New Delhi next week, where he is scheduled to meet prime minister Narendra Modi. The meeting is scheduled for Monday as part of his India visit, during which the tech billionaire is expected to disclose his strategies for venturing into the world’s fourth-largest automotive market, where the adoption of electric vehicles (EVs) is still in its nascent stages. India’s EV market is small but growing and dominated by local carmaker Tata Motors. EVs made up just two per cent of total car sales in 2023, but the government is targeting 30 per cent of new cars to be EVs starting 2030.

India has been recognized as one of the leading offshoring locations globally, according to the latest report from Knight Frank titled “Asia Pacific Horizon: Harnessing the Potential of Offshoring”. The report highlights that the Indian offshoring market has evolved itself as a significant occupier in India’s office space with leasing of over 46 per cent of office space in 2023. In India, the Global Capability Centres (GCCs) have emerged as the primary offshore occupier. According to the report in 2023, India’s offshoring market witnessed an increase in leasing volume, reaching 27.3 million square feet, marking a rise of 26 per cent from the previous year.

The Adani family, led by Indian billionaire Gautam Adani, has bolstered its ownership in Ambuja Cements to 70.3 per cent from 66.7 per cent, investing Rs 83.39 billion (£801.1 million) to aid the cement manufacturer in expanding its production capabilities, Reuters reported. Ambuja disclosed that the Adani family raised its stake by converting warrants into shares in a filing on Wednesday. This marks the third investment round, following earlier ones in October 2022 and March 2024, completing the family’s Rs 200 billion (£1.92 billion) investment in the cement maker, acquired from Swiss building materials giant Holcim in 2022. The infused capital will be utilized to elevate Ambuja Cements’ manufacturing capacity to 140 million tonnes per annum by 2028, up from around 76 MTPA as of December end.

The Indian economy is projected to grow by 6.5 per cent in 2024, according to a report by the UN which noted that multinationals extending their manufacturing processes into the country to diversify their supply chains will have a positive impact on Indian exports, Reuters reported. UN Trade and Development in its report released on Tuesday said that India grew by 6.7 per cent in 2023 and is expected to expand by 6.5 per cent in 2024, continuing to be the fastest-growing major economy in the world. “The expansion in 2023 was driven by strong public investment outlays as well as the vitality of the services sector which benefited from robust local demand for consumer services and firm external demand for the country’s business services exports,” the report said.

(With agencies)

![]()