- Wednesday, July 02, 2025

By: Shubham Ghosh

HERE are news in brief on Indian economy and business for Monday, January 29, 2024:

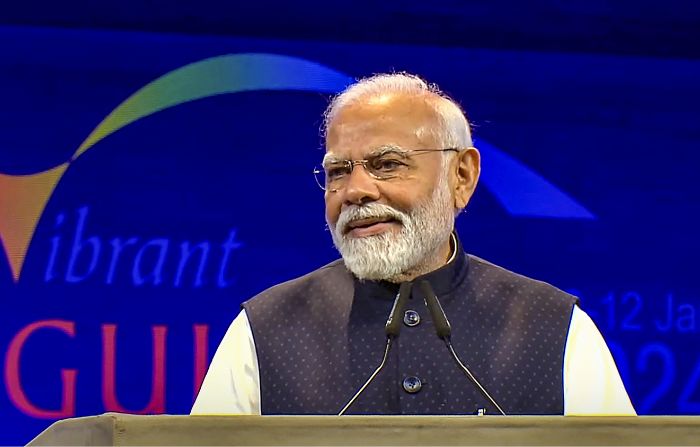

Indian prime minister Narendra Modi will next week meet chief executives of top Indian and foreign oil and gas companies, where topics such as energy supplies amid geopolitical conflicts and attracting investments are likely to be discussed. The country’s oil minister Hardeep Singh Puri said the meeting will happen on the sidelines of the second edition of India Energy Week in the western coastal state of Goa between February 6 and 9. Modi had in recent years used annual jamboree of oil and gas sector — previously as CERA India Week and now India Energy Week — to meet chief executives of major oil and gas companies with a view to understanding the emerging energy scenario as well as to drum up investments in the energy sector of the country.

Defence major Rolls-Royce on Monday said it inked a long-term agreement with Azad Engineering, headquartered in the Indian city of Hyderabad, to manufacture and supply “complex components” for military aircraft engines. Through the strategic partnership, Azad Engineering will join the global supply chain for complex category components for Rolls-Royce’s technologically advanced aero engines, it said. “As we work towards strengthening the defence ecosystem, we are happy to expand our supply chain in India in partnership with Azad Engineering,” said Alex Zino, the executive vice president of Rolls-Royce’s Business Development and Future Programmes division.

India can aspire to become a $7 trillion (£5.5 trillion) economy in the next six to seven years, its finance ministry said in its monthly review report. At present, the Indian economy is estimated to be about $3.7 trillion (£2.9 trillion). “This will be a significant milestone in the journey to delivering a quality of life and standard of living that match and exceed the aspirations of the Indian people,” it said. Firm GDP growth forecasts, inflation at manageable levels, political stability and signals that the central bank has tightened its monetary policy have all contributed to painting a bright picture for the Indian economy. In the next three years, India is expected to become the third-largest economy in the world with a GDP of $5 trillion (£3.9 trillion), it asserted.

Investment in health has stagnated and hospitals in the government sector and their human resources must be strengthened, the president of the Indian Medical Association, Dr RV Asokan, has said. Speaking to ANI ahead of the interim budget to be presented by finance minister Nirmala Sitharaman on Friday (1), Asokan said that investment in the health space has stagnated even as disease burdens have risen. “Our health investment has stagnated at 1.1 per cent of the GDP for many years. This underfunding is a reason for poor infrastructure and lack of human resources. So we feel without including the budget of drinking water sanitation, which we call health determinants, the core health budget should be at least 2.5 per cent…,” he told ANI over an online video interview.

Indian ed-tech startup Byju’s announced plans on Monday to raise $200 million (£158 million) via a rights issue of shares to address immediate liabilities and operational expenses, aiming to stabilise its business amid financial strain. Backed by investors such as General Atlantic, Prosus, and Silver Lake, Byju’s did not disclose shareholder engagement details, pricing, or fundraising timeline. The company faces challenges, including bankruptcy proceedings initiated by lenders and negotiations over repayment of a $1.2 billion (£947 million) term loan. Recent reports suggest Byju’s seeks over $100 million (£79 million) from existing shareholders, albeit at a substantial 90 per cent discount from its 2022 valuation of $22 billion (£17.3 billion), to settle vendor dues, Bloomberg News. Valuation markdowns by BlackRock (95 per cent to $1 billion or £789 million) and Prosus NV (to under $3 billion or £2.36 billion) compound Byju’s financial woes.

(With agencies)