- Tuesday, July 01, 2025

By: Shubham Ghosh

HERE are news in brief on Indian economy and business for Monday, September 11, 2023:

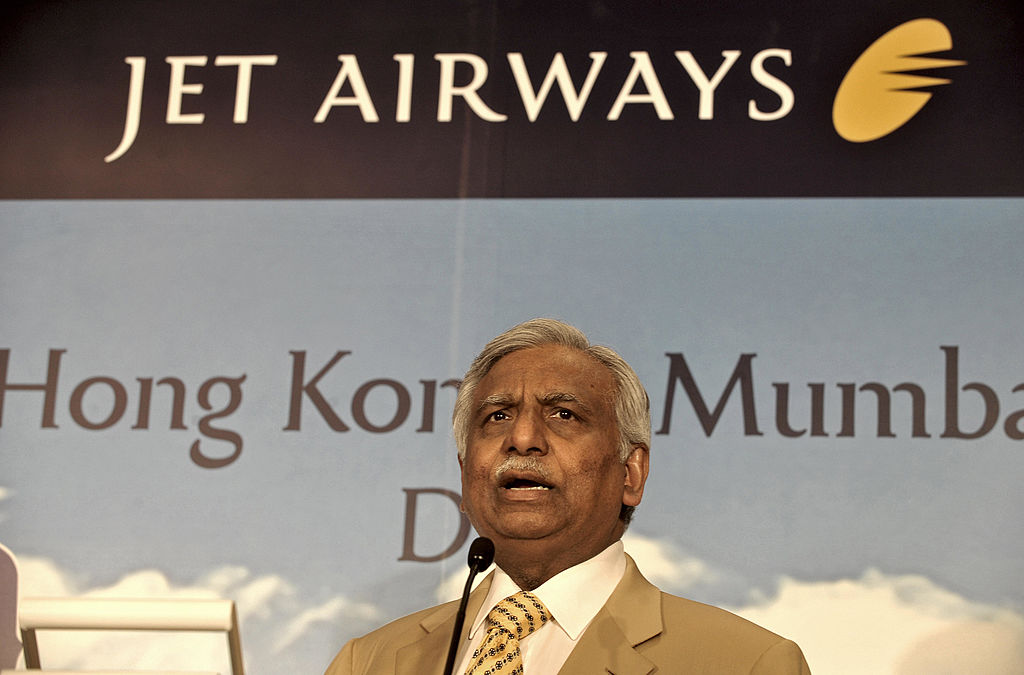

Naresh Goyal, the founder of the now-defunct Jet Airways who has been arrested in an alleged Rs 538 crore (51.8 million) bank fraud case, siphoned off funds from India to overseas by creating various trusts and used them to buy properties, a special court in Mumbai said on Monday, citing investigation carried out so far by India’s economic crime-fighting agency Enforcement Directorate (ED). The agency told the special court set up under the Prevention of Money Laundering Act (PMLA) that maximum money that was siphoned off has been stacked in foreign accounts. Goyal (74), whose ED custody was extended till September 14 by the court, told the judge he was ailing and needed to be hospitalised.

Indian market regulator Securities and Exchange Board of India (SEBI) suppressed important facts from the country’s Supreme Court and “slept over” Directorate of Revenue Intelligence’s letter on alleged stock manipulation by the Adani firms, one of the PIL (public interest litigation) petitioners in the Adani-Hindenburg row has alleged in the top court in an affidavit. On August 25, SEBI had informed the apex court it has completed the probe in all but two allegations against the Adani Group, and is still awaiting information from five tax havens on the actual owners behind the foreign entities that have invested in the conglomerate.

Saudi Arabia on Monday said it will consider setting up an office of its sovereign wealth fund (SWF) in Gujarat International Finance Tec-City (GIFT) to facilitate investments. Saudi investment minister Khalid A Al Falih said that within the next few weeks, he would send a strong delegation to GIFT City to explore the opportunity. “I will match your offer and commit today that we will open an office in India for investment facilitation…we are talking about bi-directional (facilitation),” he said at the India-Saudi Arabia Investment Forum meet in New Delhi. He said this in response to a request by Indian commerce and industry minister Piyush Goyal. GIFT City in Gujarat is a multi-purpose special economic zone for financial services.

India’s Central Bureau of Investigation (CBI) has registered a first information report (FIR) against a Mumbai-based company, PAL Trading, for allegedly siphoning off money loaned from the State Bank of India (SBI) through 17 shell companies, causing a loss of Rs 24 crore (£2.3 million) to the bank, officials said Monday. The CBI has booked the company and its directors Rinku Patodia and Anita Patodia on a complaint from the SBI giving details of the modus operandi detected during a forensic audit of the company dealing in fabrics. The bank had sanctioned credit facilities of Rs 22 crore (£2.1 million) in 2007 to the company which resulted in the outstanding of Rs 24.20 crore (£2.33 million) on the date of non-performing assets on December 27, 2012.

Reliance Retail Ventures Limited (RRVL) announced on Monday that the global investment firm KKR, through an affiliate, will invest Rs 2,069.50 crore (£199.4 million) into RRVL, a subsidiary of Reliance Industries Limited. The investment values RRVL at a pre-money equity value of Rs 8.361 lakh crore (£80.5 million), which makes it among the top four companies by equity value in the country. KKR’s follow-on investment will translate into an additional equity stake of 0.25 per cent in RRVL on a fully diluted basis. This, combined with its stake from its investment of Rs 5,550 crore (£535 million) in RRVL in 2020, will take its total equity stake in RRVL to 1.42 per cent on a fully diluted basis. The previous fund-raise round by RRVL in 2020 from various global investors of an aggregate amount of Rs 47,265 crore (£4.55 billion) was done at a pre-money equity value of Rs 4.21 lakh crore (£40.5 billion).

(With agencies inputs)