In an intensifying row over tariffs and energy imports, the Indian government has strongly rebutted US President Donald Trump’s latest threats to further hike tariffs on Indian goods. Trump has accused India of profiteering from the Russia-Ukraine conflict by purchasing discounted Russian oil, refining it, and reselling the products internationally for “big profits.” He warned in a Truth Social post that if this continued, he would “substantially raise the tariff paid by India to the USA.”

New Delhi swiftly responded, calling the targeting of India “unjustified and unreasonable,” and vowed to take “all necessary measures” to safeguard its “national interests and economic security.” India’s Ministry of External Affairs (MEA) emphasized that the import and processing of Russian oil is a matter of national compulsion dictated by global market realities, not opportunism.

India’s defense: Energy security and global market logic

The MEA’s strong statement underlined that India turned to Russia for oil only after its traditional suppliers diverted shipments to Europe at the start of the Ukraine war. The ministry recalled that the US and European Union, at the outset of the war, actually encouraged India to import Russian oil to stabilize global markets and support broader energy price caps.

India’s imports of Russian oil, the MEA explained, are “a necessity compelled by the global market situation,” intended to keep domestic energy prices predictable and affordable. The statement further pointed out US and EU hypocrisy—highlighting that both continue significant trade with Russia, including in energy and critical materials, even while criticizing India’s purchase decisions.

Call-outs and comparisons: Trade flows exceed India’s

To bolster its case, the Indian government provided concrete examples: “The European Union in 2024 had a bilateral trade of 67.5 billion euros in goods with Russia and an additional 17.2 billion euros in services in 2023—significantly more than India’s total trade with Russia.” Europe’s imports from Russia encompass not only energy but also fertilizers, chemicals, mining products, and transport equipment.

Similarly, the MEA highlighted how the US continued to import Russian uranium hexafluoride for its nuclear sector, as well as palladium for electric vehicles, fertilizers, and chemicals, reinforcing that Western criticism is selective and ignores its own ongoing Russian trade.

Pressures mount on India’s oil strategy

Trump’s rhetoric and policy signals come as India and the US are struggling to reach a comprehensive trade agreement, with agricultural market access and Russian oil imports proving persistent stumbling blocks. While the US sees pressure on India as part of its broader campaign to isolate Moscow economically and expedite an end to the Ukraine war, India frames its oil imports as pragmatic, market-driven decisions not subject to foreign diktats.

India’s strategic calculus is complicated by the US and Europe’s tightening stance. Indian refiners have reportedly begun scaling back Russian oil imports—especially public sector companies—amid a flurry of warnings and ahead of any official tariff “penalty.” July 2025 saw Indian imports of Russian crude fall to 1.6 million barrels per day, a 24% reduction from June levels, and a marked decline from the previous year’s volumes. The share of Russian oil in India’s overall import basket dropped to approximately 34% in July, down from 44.5% the previous month.

Experts suggest India is now “walking a fine line between energy security and geopolitical pressure,” and that a pivot away from Russian supplies may be necessary—both for logistical and diplomatic reasons—as the threat of further penalties looms.

Fact check: India’s oil trade and export practices

Trump’s accusation that India is reselling Russian oil “on the open market for big profits” requires some clarification. India does not export crude oil; it imports considerable quantities, then refines them into fuels such as petrol, diesel, and jet fuel for domestic use and for export. Critics argue India’s purchases of discounted Russian crude allow it to undercut rivals in fuel exports, sometimes even sending refined products to Europe—despite Europe’s own bans on direct Russian petroleum imports.

The Indian government, for its part, insists this practice is legitimate and in line with global trade norms, especially as Russian crude is not a sanctioned product but merely subject to price caps intended to limit Moscow’s wartime revenue. Indian refineries note that the international fuel market makes it challenging, if not impossible, to trace the origins of specific barrels once refined.

Importantly, the Biden administration’s earlier approach relied on keeping Russian oil marketable, albeit capped in price, to avoid energy shortages and price spikes worldwide. Trump’s more combative strategy, with threats of direct financial penalties against Russian oil importers, signals a harder line that could disrupt global flows if implemented.

Competitive dynamics: China, penalties, and trade negotiations

While India has drawn much US attention, China remains the largest importer of Russian oil, with $62.6 billion of purchases in 2024 compared to India’s $52.7 billion. Yet, the Trump administration has focused its punitive rhetoric more squarely on India. Analysts note that China, for its part, has aggressively cut prices to retain access to the US market, even as it faces elevated tariffs and races against an August 12 deadline for a potential trade deal with the US.

As exporters in India voice concerns over competitiveness—especially in low-margin sectors like apparel and footwear, which now face higher tariffs than rival countries such as Bangladesh and Vietnam—there is growing anxiety about the impact on jobs and economic momentum.

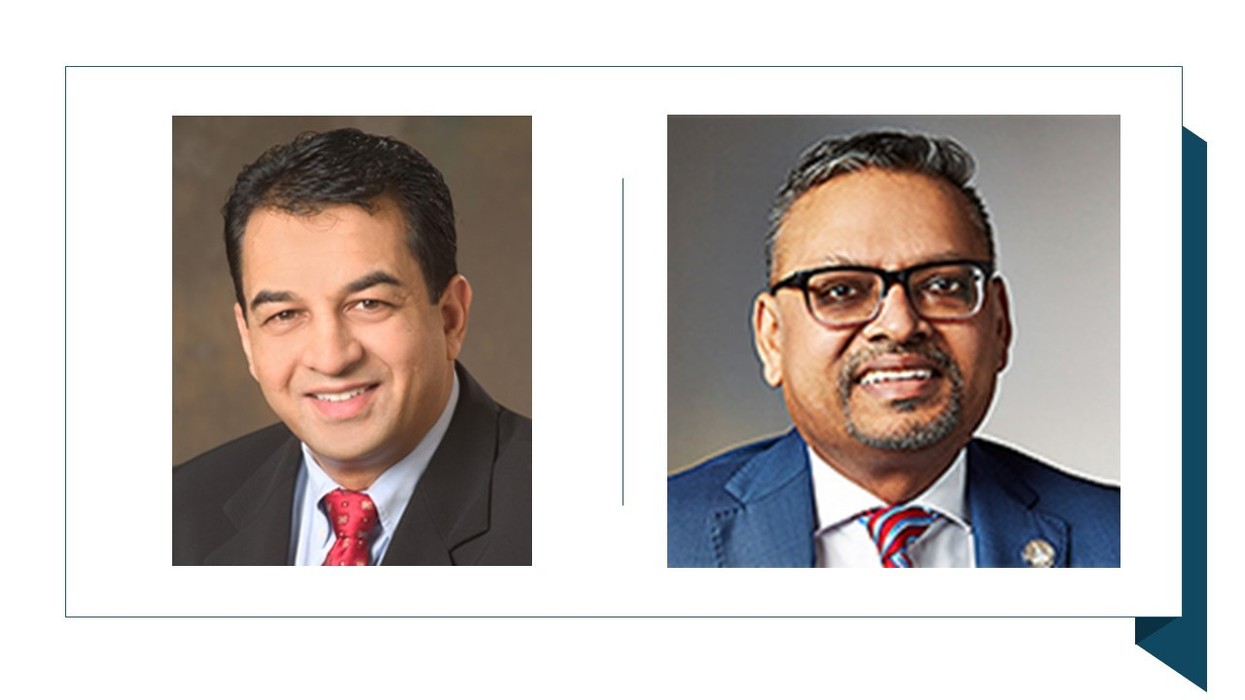

Indian leadership responds

Both prime minister Narendra Modi and external affairs minister S Jaishankar have spoken up in defense of India’s interests this week. Modi, addressing a rally, pointed to India’s aspirations to become the world’s third-largest economy and stressed the need to remain vigilant over economic interests amid global volatility.

Jaishankar, at New Delhi’s BIMSTEC traditional music festival, called for a more equitable global order, stating: “There is a collective desire to see a fair and representative global order, not one dominated by a few.” This sentiment reinforces India’s stance that energy decisions will continue to be guided by its own needs, market realities, and global circumstances—not external pressure.

The clash over oil and tariffs highlights the complex intersection of geopolitics, economics, and energy security shaping India-US relations in 2025. As New Delhi signals its readiness to safeguard national interests “by all necessary means,” the impasse underscores the challenges of global diplomacy in an era of fractured supply chains, overlapping crises, and assertive statecraft.

Both sides are watching whether further escalation will lead to meaningful compromise—or whether economic and diplomatic realignments are on the horizon, with ripple effects felt far beyond the US-India corridor.