US President Donald Trump has reignited tensions with the BRICS coalition by threatening an additional 10% tariff on any nation aligning with what he calls the group’s “anti-American policies.” In a recent social media post, Trump declared there would be “no exceptions” to this policy, emphasizing his administration’s hardline stance against efforts to challenge US economic dominance. This warning comes as the US dollar hits a three-year low, having declined more than 10 per cent against major currencies in 2025 amid fiscal and political uncertainty.

BRICS: Expanding Influence and Membership

Originally formed by Brazil, Russia, India, China, and South Africa, BRICS has rapidly expanded its membership. At the October 2024 summit in Kazan, Russia, the bloc formally admitted Egypt, Ethiopia, Iran, and the United Arab Emirates. Indonesia joined in January 2025, bringing the total to ten member nations. Today, BRICS represents approximately 45 per cent of the global population and contributes over 35 per cent to the world’s GDP, solidifying its role as a major force in the global economy.

Recent Expansion Highlights

- New members (2024-2025): Egypt, Ethiopia, Iran, UAE, Indonesia

- Partner nations invited: Belarus, Bolivia, Cuba, Kazakhstan, Malaysia, Thailand, Uganda, Uzbekistan

- Global impact: Nearly half of the world’s population and over 41 per cent of global GDP (PPP)

The De-Dollarization Debate and BRICS Currency Proposals

The push to reduce reliance on the US dollar has gained momentum since the US excluded Iran (2012) and Russia (2022) from the SWIFT system, prompting Russia and China to settle trade in their own currencies. In June 2022, Russia proposed a new international reserve currency based on a basket of BRICS currencies.

However, BRICS leaders have clarified that their aim is not to replace the dollar but to provide an alternative that enhances market efficiency and promotes inclusive economic globalization.

- Reserve currency proposal: Based on a basket of BRICS currencies, inspired by the IMF’s Special Drawing Rights (SDRs)

- Current status: No consensus on a shared currency; focus remains on facilitating local currency trade and financial autonomy

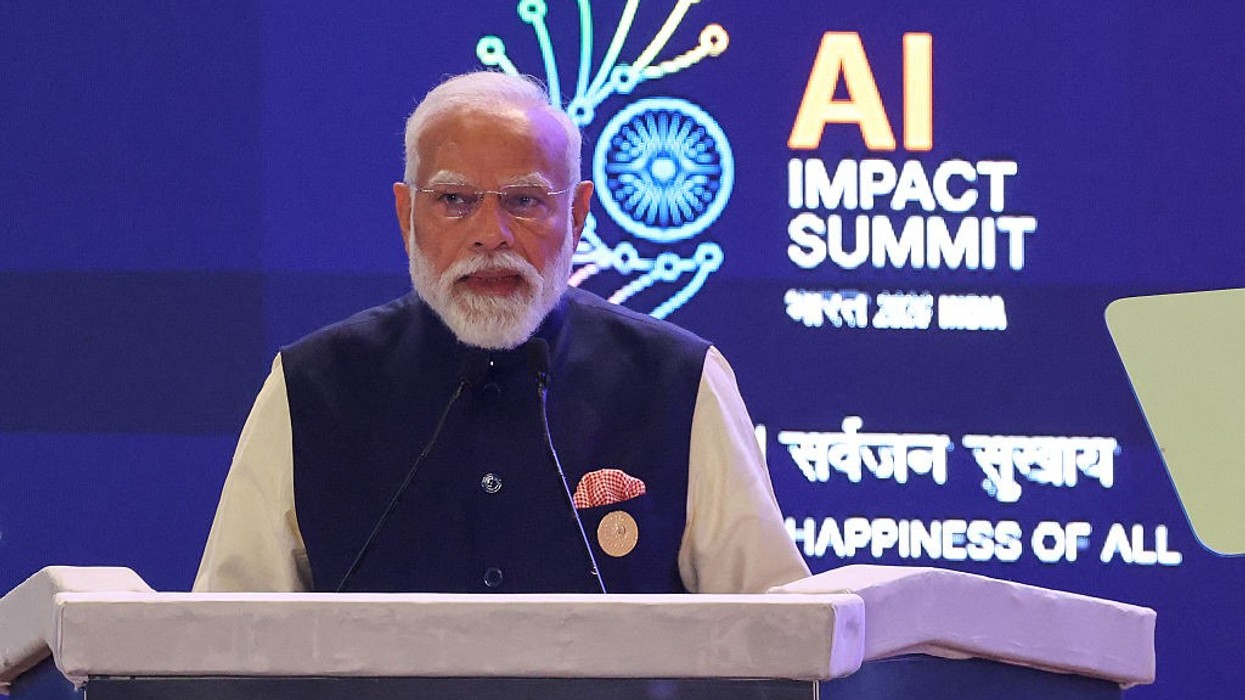

- India’s Position: India has taken a nuanced stance within BRICS, distancing itself from aggressive de-dollarisation. External Affairs Minister S. Jaishankar and former RBI Governor Shaktikanta Das have both emphasized that India is not targeting the dollar. Instead, India’s recent measures—such as allowing Vostro accounts and local currency trade agreements—are designed to “de-risk” its trade, not undermine the dollar’s dominance.

Key Statements from Indian Officials

- S. Jaishankar: “We have never actively targeted the dollar. That’s not part of our economic, political, or strategic policy… There’s no malicious intent towards the dollar.”

- Shaktikanta Das: “This is not about de-dollarization; it is about de-risking our trade. The geographical spread of BRICS nations poses unique challenges for a single currency.”

India’s caution is also driven by concerns over the rising influence of the Chinese yuan. While the yuan has become Russia’s most traded currency post-sanctions, India has resisted using it for Russian oil imports, wary of frameworks that could disproportionately benefit China.

The US Dollar’s Decline and Global Reactions

Trump’s tariff threats coincide with the US dollar’s steepest six-month drop since 1973, falling over 10 per cent against major currencies in the first half of 2025. This decline is attributed to fiscal concerns, political volatility, and the Trump administration’s unpredictable trade policies. The weakening dollar has encouraged some nations to explore alternatives, though most—including India and Brazil—remain cautious about fully abandoning the greenback.

Global Responses and Outlook

China has responded to Trump’s threats by reiterating that BRICS is not seeking confrontation but rather cooperation and inclusive development. Beijing opposes the use of tariffs as political leverage, emphasizing that BRICS aims to build a more balanced global order.

As the BRICS coalition expands and the debate over global currency dominance intensifies, India’s pragmatic approach and Trump’s renewed tariff threats highlight the complexities of a rapidly shifting economic landscape. The coming months will test the resilience of global trade frameworks and the ability of major economies to navigate mounting geopolitical and financial pressures