- Friday, April 19, 2024

By: Shubham Ghosh

THE year 2021 proved to be a happening one in India’s business sector. While it was the best IPO (initial public offering) year for Indian primary markets in the last two decades with more than 60 companies getting listed in the calendar year, it also saw the selling of the country’s national carrier Air India to Tata Group, its founding father.

Besides, the Narendra Modi government also made known its intention of banning private cryptocurrencies. The Adani Green Energy Limited (AGEL) also completed this year the acquisition of SB Energy Holdings Limited (SB Energy India) in a cash deal worth $3.5 billion (£2.5 billion), marking it as the largest acquisition in the renewable energy sector in the country.

ALSO READ: Rewind 2021: One of India’s best years in sports

Here are top five news from India’s business sector in 2021:

Food delivery platform Zomato made a grand debut on bourse in July and in three days, Zomato IPO received bids for 27,51,27,77,370 shares against issue size of 71,92,33,522 shares. The IPO of Zomato was India’s biggest initial share sale offer since March last year. The IPO had opened for subscription on July 14 in a price band of Rs 72-76 (£0.72 – £0.76) per share. It closed on July 16 and shares of Zomato were listed at Rs 116 (£1.15) apiece, a premium of 53 per cent to the IPO price of Rs 76.

Nykaa’s, previously called FSB E-Commerce Ventures Ltd., share-listing made investors rich with the stock almost doubling from the IPO price. The price band for the Nykaa IPO was set at Rs 1,085-1,125 (£10.79 – 11.18) per share, at the upper end of which the company was valued at Rs 53,204 crore (£5.2 billion). With a market capitalization of $14 billion, Nykaa broke into the elite club of India’s top 100 most valuable companies. Its founder and CEO Falguni Nayar became India’s richest self-made woman billionaire, according to the Bloomberg Billionaires Index.

In the case of PayTM, things were less rosy. The IPO of One97 Communications, the parent company of PayTM, was open for subscription from November 8 to 10. The IPO worth Rs 18,300 crore (£1.8 billion) was the largest in India’s corporate history. But the issue failed to get the expected response from investors and PayTM shares lost more than 37 per cent.

The IPO of PB Fintech (operator of Policybazaar and Paisabazaar) made a decent start at the stock markets in November with 17.35 per cent premium. The IPO of the country’s biggest online insurance aggregator was subscribed more than 16 times. The price band was set at Rs 940-980 (£9.34-9.74) a share, which ascribed the company a Rs 44,051 crore valuation.

The AGEL completed the acquisition of SB Energy India in a mega $3.5 billion deal – the largest acquisition in the renewable energy sector in India.

The deal was announced in May and was set to help the AGEL get closer to its goal of achieving 25GW renewable energy capacity.

“The addition of these high-quality large utility-scale assets from SB Energy India demonstrates Adani Green Energy’s (AGEL) intent to accelerate India’s efforts to transition towards a carbon neutral future. Our renewable energy foundations will enable an entire ecosystem of new industries that can be expected to catalyse job creation in multiple sectors,” Vneet S Jaain, AGEL managing director and CEO said.

The Indian government finally succeeded in selling the flagship national carrier Air India and it returned to none other than its founding father – the Tata Group. The salt-to-software conglomerate won the bid to acquire the debt-trapped carrier offering Rs 18,000 crore (£1.7 billion) for acquiring complete shareholding. The Tatas beat SpiceJet promoters to clinch the bid.

The takeover, however, was likely to see a month-long delay as the completion of procedures takes longer than expected.

The government accepted the highest bid made by a Tata Sons company for 100 per cent equity shares of Air India and Air India Express along with its 50 per cent stake in AISATS, the ground-handling company.

The Narendra Modi government has made its intention clear this year to introduce a bill to ban all private cryptocurrencies in India. In January, a Lok Sabha bulletin said that the government was set to bring in a bill that would ban all private cryptocurrencies. In the budget session 2021 which was presented on February 1, the government had planned to introduce a bill to ban the private cryptocurrencies in India and put in place the framework for an official digital currency to be issued by India’s central bank – the Reserve Bank of India. While the bill was not tabled immediately, the government once again appeared to bring in the bill in November banning the cryptocurrencies during the winter session of the parliament. From Reserve Bank of India governor Shaktikanta Das to prime minister Narendra Modi, opinions were expressed against the cryptocurrencies. Indian finance minister Nirmala Sitharaman said the government is working out a new bill on banning cryptocurrency.

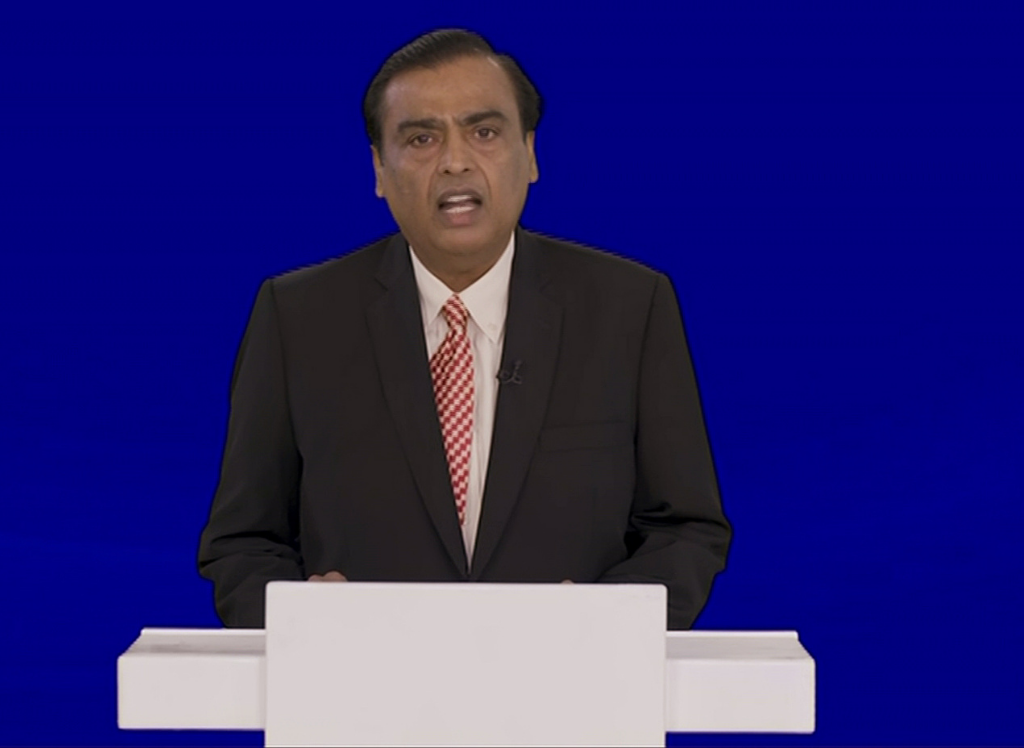

Mukesh Ambani, the chairman of Reliance Industries Limited and Asia’s richest man, gave a hint in December end that the conglomerate is in the middle of a “momentous leadership transition”. Speaking in a virtual speech on Tuesday (28) to a Reliance Industries’ employees’ event, Ambani, 64, said the company “is now in the process of effecting a momentous leadership transition from seniors belonging to my generation to the next generation of young leaders”. It is anticipated that Ambani wants to avoid a succession warfare which has hurt many wealthy families, including his own in the past. The transition at Reliance will be one of the most eagerly awaited events in the business world.

![]()