- Friday, April 19, 2024

By: Shubham Ghosh

IN the wake of missing two self-imposed deadlines, India’s Reliance Industries Limited has shelved a proposal deal to sell a 20 per cent stake in its oil refinery and petrochemical business to Saudi Aramco for an asking of $15 billion (£11 billion) as the Indian company focuses on new energy business.

“Due to evolving nature of Reliance’s business portfolio, Reliance and Saudi Aramco have mutually determined that it would be beneficial for both parties to re-evaluate the proposed investment in O2C (oil to chemicals) business in light of the changed context,” Reliance said late on Friday (19), adding that it will continue to be Saudi Aramco’s “preferred partner” for investments in India’s private sector.

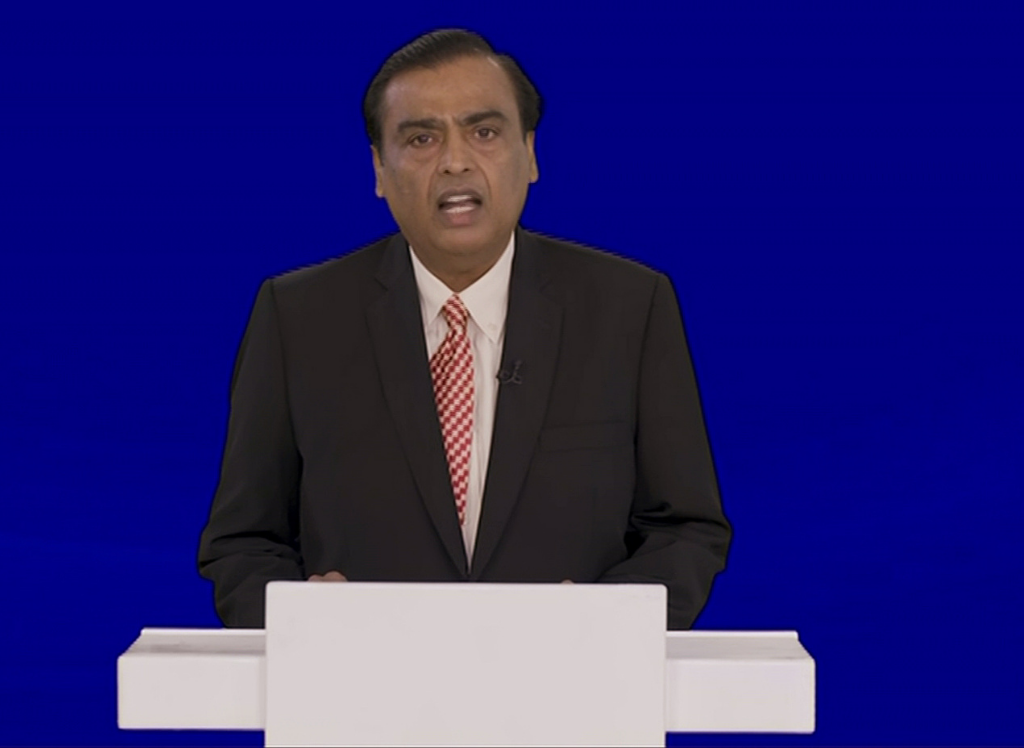

Mukesh Ambani, the richest India and the chairman of Reliance, had in the company’s annual general meeting (AGM) of the shareholders in August 2019 announced talks to sell 20 per cent in the O2C business, which comprises its twin oil refineries in Jamnagar in the western Indian state of Gujarat, petrochemical assets and 51 per cent stake in fuel retailing joint with BP, to the world’s largest exporter of oil.

At the time, he had announced that the deal would close by March 2020. The deadline was, however, missed and the company put the blame on pandemic-induced restrictions imposed towards the end of the same month.

This year, too, Ambani said at the AGM that the deal would be closed by the end of the year. He also announced at the same time new energy forays, including a plan for setting up one of the largest integrated renewable energy manufacturing facilities in the world.

While new deadlines for Aramco deal and new energy forays were declared in the same breath, it is not clear however what changed between June and now to site shifting focus for the “re-evaluation”.

Reliance has also decided to withdraw the proposal filed before the National Company Law Tribunal (NCLT) to separate O2C business from the company, Press Trust of India reported. New energy businesses are housed in separate subsidiaries of RIL and are not part of O2C. It was also not clear why the separation proposal filed before NCLT was withdrawn if Aramco remained interested in buying a stake in the O2C business and the deal could be concluded in future.

![]()